Quick read bullets:

- Set up autopay AND paperless billing for all of your recurring bills, directing them to be paid in full by your credit card. Do this from the website of each individual company, and not your bank account’s bill pay software (unless that’s the only way you can do it.)

- Pro tip: as you go, save the logins & passwords from each company’s site to Google Chrome or LastPass to avoid having to remember them, saving you time & avoiding frustration.

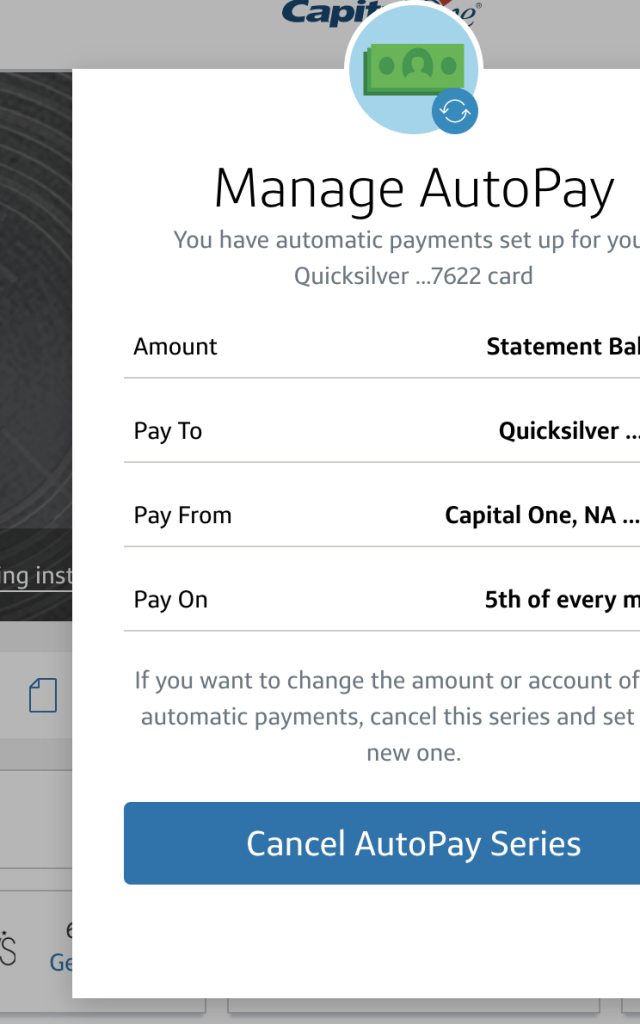

- Next, set your credit card to autopay (and paperless billing) on the due date for the full balance. (Bonus points if you also change your credit card due date to the 4th or 5th of the month so that you can pay it right after your rent/mortgage. See my easy no-budget budgeting system for why this is a good idea.) If you are carrying a credit card balance and can’t pay it off in full yet, set your autopay to the minimum balance instead, and make extra payments on an ad hoc basis to pay down your balance ASAP.

- You’ll still receive your bills via email (or paper, if you prefer) so you have plenty of time to check them and make sure they’re correct before the payments get made in case this worries you. You can cancel the autopay at any time, so there’s no risk of paying something you shouldn’t so long as you’re still checking your statements. (I don’t think I’ve ever once found an incorrect charge on my credit card, except once when my account info was stolen, but it doesn’t hurt to be vigilant!)

Why autopay everything?

Automation frees up your time and more importantly, your mental energy. You never have to worry about missing a bill or getting a late fee again. It keeps your financial system humming along, even while you’re on vacation or off the grid.

Why doesn’t everyone do this?

Some people are resistant to embracing autopay, so there’s definitely some psychology to overcome if you’re one of them. The resistance I get is usually something like: “I want to be in control/I don’t trust the autopay!”

My answer? You are still in control, and even more so since you’ll never miss a payment or get charged a late fee again now! You’ll see every bill show up in your email well before it gets paid, so you can still go through everything line by line to make sure the charges are legit if you want to. (I still do with my credit card statements.)

In the same amount of time it would have taken to pay the bill, you can easily login and cancel the autopay one time or permanently if you ever needed to. Autopay isn’t set in stone: it just changes your default behavior to paying all your bills in full and on time, and that is very good default behavior to have!

The most impactful financial advice I give is about setting up systems to make good financial things happen by default. Take advantage of this powerful technique wherever you can, and make life easier on yourself in the process.

How to set up autopay on everything

I start by putting all of my recurring bills like internet, phone, utilities, digital subscriptions, gym membership, car payment, auto insurance etc on my credit card using the autopay on the billing company’s site.

I use the company sites instead of my bank’s bill pay because

1) I want to use my credit card and

2) I think it’s more direct to pay straight to the billing company (no middle man to screw things up) and

3) it forces me to make sure I have online access and a remembered password to all of my financial sites, which is very important.

Once I’m done with setting everything to autopay with my credit card, I only have one bill per month hitting my checking account, which simplifies things when I glance at my checking account statements to see what I’m spending on a monthly basis.

If there are any bills that don’t let me, or would charge me extra to, use a credit card (public utilities, for example), I set up automatic ACH checking account withdrawals instead.

Setting up autopay on my internet bill

I log in to Comcast/Xfinity, then navigate to the billing area, and click the autopay link at the bottom left of the screenshot. For your bills, try googling ‘[company name] set up autopay’.

Then I add my credit card info (this is all perfectly safe; don’t worry!), and just follow the prompts to turn it on:

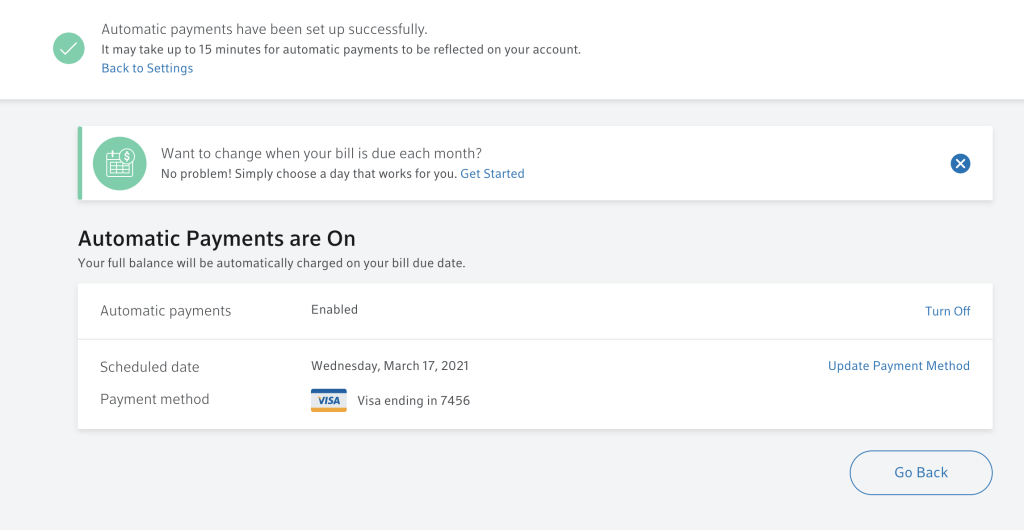

I do the same thing for all my other bills. Then I set up autopay on my credit card to pay the full bill each month on the due date.

If you have a balance you can’t pay off in full yet, set up autopay for the minimum balance to avoid any late fees on missed payments, and then make manual payments to pay down the balance ASAP.

Once you’re done, you’ll have autopay set up looking something like this:

If my landlord or mortgage company offers electronic autopay, I set that up too, which will usually come straight from your checking account instead of your credit card. Every one I’ve dealt with over the past 5 or 6 years has had an autopay option, so yours probably does too.

If you use Capital One 360, you can even schedule a physical check to be mailed to any landlords that force you to use paper checks. Just log into your bank’s bill pay service to see what your options are. Zelle is another popular option for electronic bill pay that many banks use, including Capital One.

Your turn!

Take 30 minutes to do this yourself for all your bills, credit card, and then rent/mortgage. Afterward, you’ll have just a few monthly bills hitting your checking: 1) rent/mortgage, 2) credit card(s), maybe 3) a utility bill that you couldn’t use your credit card to pay, and 4) any cash or debit card transactions you have.

This makes it a lot easier to see your monthly spending.

*Boom!* You just saved yourself a ton of repetitive work logging into sites and making bill payments each month. You can check your emailed statements monthly to keep any eye on things, and then kick back and have a coffee or a whiskey (or a homebrewed cider!) while the machines do all the work!