Investing and saving tips get a lot of play in the financial advice columns, but the most fundamental step in building wealth is figuring out where your money is going.

First, jot down all the ways that money comes out of your accounts & pockets. This means any bills that come straicapight out of your checking/savings accounts, any credit and debit cards you use, and any cash you pull out of the ATM, or cash that you receive as gifts or income and then spend.

My wife & I keep a joint account for shared expenses as well as our own individual accounts, so I’ll share with you my half of the joint expenses + my solo expenditures.

Here are all of the ways money flows out of my accounts:

- Bills that get paid individually straight from my checking account, which includes our mortgage & property taxes, as well as some city utilities, and the handful of checks I write each year. I try to use automatic, electronic billing direct from my checking or credit cards for everything, and Venmo/Paypal/bank transfer for payments to individuals, so I almost never have to write a check.

- Credit cards: My personal no-fee, cash back Capital One credit card, which auto-pays from my checking for the full amount due, and our joint no-fee cash back Chase credit card which pulls automatically from our joint checking.

- PayPal and Venmo, which both pull from my checking account

- Cash: I use the highly-recommended no-ATM fee Schwab Investor checking to spend cash from an ATM or debit card.

Now let’s figure out how much I spent in total from those accounts and what the specific bills were for. (We’ll breakdown the credit card payments later.)

If you are spreadsheet-phobic, skip down to The Approximate Method – Pen & Paper. Otherwise, pop open your favorite spreadsheet program and follow along.

The Best Method – Using a spreadsheet

Hopefully your bank has all your transactions online, so all you gotta do is download them and take a look. It’s easiest to dump everything into a spreadsheet, and I recommend doing that if this is the first time you’re doing this. If you can’t be bothered, at least glance at the past couple of months of statements and jot down some rough numbers that accurately reflect your monthly averages.

I bank with, and highly recommend, this bank, so let’s login over there and see what I spent in total for the past 12 months.

Above: my bank has a handy ‘Download Transactions’ widget where I can download everything as a CSV so that I can open it in Excel or Google Sheets.

Above: I’ll grab a year’s worth of data and export it as a CSV.

Above: Here’s what the CSV file looks like in Excel.

My bank reported my spending as debits (money paid out) and credits (money coming in.) For now, we only care about spending, so use your spreadsheet program to just filter on ‘Debits’. (Add back any Credits/reversals of charges that represent cancellations/returns.)

Next, filter out any transfers (which also show up as Debits) that just go to your other savings or investment accounts. We only care about money leaving your financial ecosystem for good, not any ‘internal’ transfers. When you’re done filtering, you should only see actual expenses being paid out to others.

Exclude any tax payments, since those are not directly under your control.

After this filtering, I added up the numbers and bucketed them into useful categories:

This tells me I spent about $35,000 last year, which sounds about right since I budget $3,000 per month for myself. This is a great start, but now I need to break out the line items for my credit cards.

Your credit card company should also let you download a CSV of your transactions. Both Chase and Capital One let you download a custom date range of at least 1 year, and they both helpfully provide spending Categories that you can use as-is, or tweak to better reflect your purchases. They also give you an ‘annual report’ each January with some mediocre category matching which you could also use vs doing it in a spreadsheet.

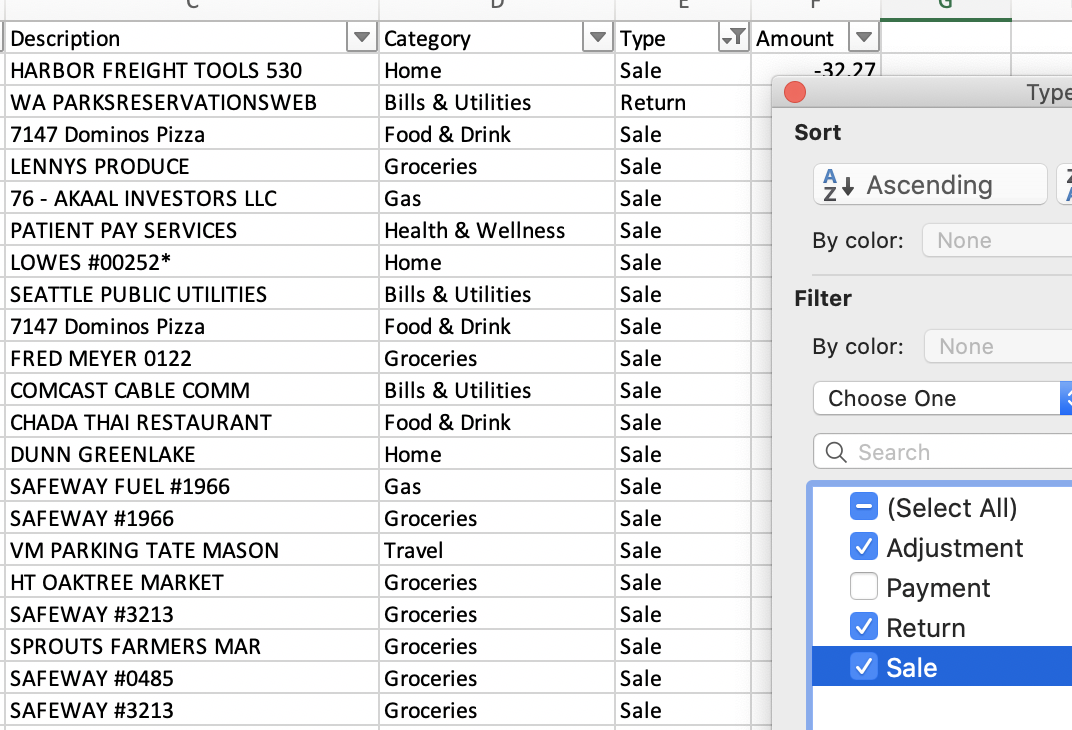

Here’s my joint Chase card’s transactions where I used the Category column to filter out my Payments to the card (keep Adjustments, which for me are cash back rewards, and Returns, since you should net those out against the Sales.)

For my Capital One card, I needed to use the Description column to filter out the my automatic payments.

I also filtered out certain expenses that my work reimburses me for like work travel and parking at the office, since there’s no net out-of-pocket cost to me for those things.

To make the categorization and accurate as possible, I went through everything and changed some of the Categories (switching Costco & Walmart from ‘Shopping’ to ‘Groceries’, for example.)

Then, I used Excel’s pivot table functionality (or Google Sheets) to sum things up using the Categories that each credit card company provided (after I edited them):

Above: my filtered solo expenses (left) and our joint expenses (right. I only pay half of these.)

Lastly, I used these two tables to combine my two credit cards into a handful of big buckets of my own choosing to get a clearer picture of everything together. I divided our joint expenses by 2 to get ‘my’ portion of the expenditure:

Above: the Holy Grail: my yearly expenses all in one table and with accurate categorization + a few notes in the ‘Expense Name’ to remind me what’s in each category and to call out any big purchases.

The takeaways:

Housing + home maintenance is by far my biggest expense (54% – $1,550/month)

I spent over half of my ~$3,000/month budget on housing. Nearly 1/3 of that is just going to utilities + property taxes, and the remaining 2/3s to the mortgage. I spent an additional 3% on home maintenance stuff, which included needing to buy a refrigerator ($900) when we moved in and also paying a plumber to unclog our sewer pipe a few months after living here ($800!), as well as tools & supplies from the hardware store.

Travel and going out is my biggest discretionary expense (22% – $615/mo.)

Travel was 12% ($335/mo.) We took a trip to Portugal for about $3,300 for the 2 of us for 12 days. We also visited my wife’s family in New Jersey. I had a bachelor party in Vegas that I was co-host for. Lodging for local weekend trips is also in here.

Coming in at 10% was eating/going out ($280/mo.) This also included miscellaneous cash expenses for activities like the State Fair, date nights, and weekend trips or local activities. Going out for drinks is also in here. (Some of this cash probably went to buying used furniture and tools for our home, but I didn’t try too hard to separate that out.)

Food & home products (12% – $335/mo.)

We cook the vast majority of our meals at home, and I spent about 7% of my budget on groceries ($400/month for the two of us.) This is lower than it normally would be because I ate a lot of my meals for free at work this past year.

About 5% of my budget was for ‘household shopping’, which included everything I buy off Amazon, as well as from big box stores like Target. I’ve been getting into hosting themed events like my inaugural basement haunted house that I put on last year for the neighborhood, so props and other things that feed my hobbies are in this bucket too.

Medical was a big expense this year because we’re having a baby (6% – $170/mo.)

We paid higher-than-usual medical expenses in preparation for having a child. We thankfully have insurance which covers most of this.

We’ve saved a good deal in our HSAs, which allowed us to pay these out-of-pocket expenses with tax-free savings & investment growth from prior years, so it wasn’t quite as painful.

Owning and driving a car (4% – $120/mo.)

Gas (about $75/month for me) + auto insurance ($380/year for my half of it) and other miscellaneous expenses ($164 for annual registration, motor oil, air filters, a new regulator to fix my automatic window) for my car ended up costing me about $120/month. My wife and I drive older cars from 2001 and 2002 respectively, so we have no car payments (a key pillar of building wealth.) I try to do most of our car maintenance and simpler repairs myself, so this is about as bare bones as it gets for dual car ownership.

I starting saving $100/month last year for a future replacement car since mine hit 200,000 miles in late 2019. Hopefully by the time it dies I’ll have enough to offset the purchase of another reliable used car.

Phone, entertainment, and home internet (3% – $83/mo.)

My cell service is inexpensive at $30/year from highly-recommended Consumer Cellular. I bought a new Moto G7 phone for $177 including tax + a protective case. It’s a ‘budget’ phone compared to Apple or a Samsung Galaxy, but as far as Android devices go I much prefer the Moto G line to the Samsung Galaxy that I use through my work.

I keep my data usage low by always leaving on the ‘data saver’ Android option, and also by connecting to wifi whenever possible like at work or home. Xfinity/Comcast, whom we use for our home internet, has a nice network of mobile hotspots that you can connect to when you’re on the go. I use wireless calling or apps like What’sApp or Google’s Duo when connected to WiFi to keep my plan minutes low to save a few bucks, but unlimited calling is cheap with Consumer Cellular too.

We had a 12 month promotion for $30/month for Comcast internet. It was set to go up to $69, but I negotiated them back down to $35 for this year. I do this every year which saves me over $300 annually with one or two quick phone or online chats to Xfinity.

For entertainment, we mooch off generous friends and family for streaming services including Netflix, Spotify, Hulu, and Disney+ and pay absolutely nothing for them. (God bless those friends & family.) We use the library and archive.org heavily for more free streaming video, downloadable audiobooks, and ebooks.

My one subscription extravagance is a Seattle Times Sunday paper delivery + digital subscription that now costs $5/week. I was on a promo deal for most of 2019, but I’ve decided to suck it up and pay the full price going forward to support local journalism.

Great job assembling all your data! Now it’s up to you to decide where to spend more or less.

Whew! It took some web & spreadsheet work, but now I have a detailed picture of where all my money is going. If I was looking to trim some expenses, I could take a hard look at several places and decide what to cut. On the other hand, maybe I’m taking fewer trips or date nights than I think is ideal, and I might decide to spend more in those areas, perhaps cutting something else to pay for it.

Seeing the big picture of your spending

Going through this exercise drives home the fact that if I wanted to reduce my current budget in a significant way, it would be hard to do so unless we moved to a cheaper place since housing by itself is already 54% of my budget.

We’re pretty good at keeping our utilities & insurance costs low, and we just refinanced to lower our mortgage bill by $140/month, so there’s nothing left to do except sell the house and move to a cheaper area if we wanted to save more on our mortgage + property taxes. (We have no such plans: we’ve consciously made the cost tradeoff to live close to our friends & jobs and be in the city for now, but maybe years down the road we’ll change our minds in order to, say, facilitate earlier retirement, or provide better public schooling for our children, or just get more house/land for our buck.

Travel & going out is our next biggest expense, but honestly, I would spend more time on travel & outings if we could. Having novel experiences, investing in productive hobbies, and making memories is probably the best way we spend our time and money. Of course, we could prioritize cheaper trips like camping & local excursions vs expensive ones like European travel, but again, we’ve consciously set aside a certain amount of our budget for these more extravagant adventures. (And we do look for discounted airfare, good hotel deals, and reasonably-priced dining and transit to get the most memorable fun for our buck.)

We’ve already set up our budget to balance comfort & experiences vs savings in a way that meets both of our needs, and we aggressively max out our tax-advantaged savings while also setting aside more savings for early retirement, so I won’t be making any major tweaks today.

That’s all well and good for me, but if you haven’t done this kind of exercise before, spend some time deciding how you might like to shift where your money is going.

This exercise is about consciously spending & saving to get the most out of life. It’s up to you to determine what that means.

What next?

Congratulations! You just did the hardest part of personal finance: figuring out where your money is going. After you’ve made some decisions on how you might change you spending & savings picture, automate your banking & budgeting with my bulletproof spending & saving system.

Happy spending!

Addendum

The Approximate Method – Pen & Paper

If you don’t want to spend the time to get detailed info and use a spreadsheet, just jot down the numbers on a piece of paper, using the info you find online to help. I found this to be MUCH more painful than using a spreadsheet. If you go this route, I’d recommend trying to focus on the big picture: get down your total spending accurately, and then just fill in the detail as best you can, starting with the biggest spending chunks.

First, I looked through the past few months of bank statements and jotted down all the payments I made from there, excluding my credit card payments which I’ll look at separately.

For your credit cards, I recommend just grabbing your most recent year-end statement and basing your estimates off that (adjusting for any big changes that might make your current spending a lot different.) Both Chase and Capital One provide nice breakdowns by month and by category, so use those to estimate the details of where your money is going. Investigate anything that represents a large chunk of money or is confusing to you (i.e.: you’re not sure what that spending represents.)

Below: Example of Capital One’s Year-end summary that you can use to quickly categorize your credit card spending

Use two pieces of paper at this point: one for the gory details as you parse through your bank statements + credit card summary, and a second one to categorize the numbers into a handful of buckets & add them up (far-right.)

Add up everything in your ‘buckets’ sheet of paper and make sure the total is roughly accurate, and you’re done! Go back up to the end of the spreadsheet method to see the next steps.